TL;DR

✅ Markets just went through a liquidation-style flush — driven by leverage unwinds and risk-off flows, not fundamentals “breaking.”

✅ The resurfacing Epstein-era emails are narrative accelerant, but the bigger signal is that rails have always been treated as competitive threats (capital pressure early → regulatory friction later).

✅ This is a V-shape candidate, not a confirmed V yet. Confirmation requires BTC holding the flush low and reclaiming the key resistance zone; failure risks another leg down.

✅ BTC is behaving like a financialized risk asset (sensitive to leverage + macro). Expect chop unless it reclaims and holds key levels.

✅ XRP is a rotation candidate: it usually doesn’t lead the first bounce, but it can outperform once the market rotates from speculation → settlement/infrastructure.

✅ This week’s play: don’t chase green candles. Scale entries and focus on Golden Age systems (rails + settlement) that survive stress.

✅ Our core thesis remains: crashes separate trades from systems — and this is where long-term Golden Age positions are built.

NOTE TO OUR SUBSCRIBERS: Please ensure you read our newsletters by accessing the online link. Each of our newsletter issues is very detailed, and most email providers cut off content. Therefore, if you only read the email body, you may miss out on valuable information. |

✨ Stay Connected

Follow Sovereign Signals on X for real-time Golden Age alerts: |

Like • Share • Follow — the rails are being built now |

🛡️ SOVEREIGN SIGNALS DYNASTY — COMING SOON |

Sovereign Signals Elite newsletter teaches how to accumulate. |

Designed for: |

Not for thrill-seeking. |

The next layer is coming online. |

🔄 Market Structure: Flush → Reprice → Rotate

What we’re seeing right now has the early ingredients of a V-shape setup — but precision matters. Not every asset rebounds the same way, and not every bounce signals repricing.

This drawdown was driven by liquidity stress, leverage unwinds, and risk-off positioning — not by “the world ending.” Futures liquidations accelerated, ETFs amplified flows, and anything heavily financialized sold first. This is textbook capitulation behavior.

But here’s the part most people miss:

📌 The Golden Age doesn’t reward panic. It rewards positioning after the flush.

Not everything bounces. Only the assets’ capital rotates in after the forced selling ends.

⚡ The Question the Market Is Asking

Markets don’t collapse all at once.

They fail along design lines.

Some assets crack under leverage.

Others absorb stress and keep functioning.

So the real question isn’t what goes down — it’s:

What breaks first… and what doesn’t?

🧩 The Epstein-Era Emails: Narrative Accelerant + Infrastructure Signal

Newly resurfaced Epstein-era email excerpts add important context to what many long suspected: XRP and XLM were viewed early on as competitive threats, not harmless experiments.

In a 2014 email now circulating widely, the sender explicitly frames Ripple and Jed McCaleb’s “new Stellar” project as “bad for the ecosystem,” noting internal pressure to reduce or remove investment allocation because investors were “backing two horses in the same race.”

This matters for one simple reason:

🧠 No one tries to defund or sideline something that doesn’t matter.

The language used isn’t ideological — it’s strategic. It reflects early recognition that settlement rails (XRP/XRPL and XLM) were competing for a role very different from speculative crypto assets.

These weren’t memes.

They were infrastructure.

.🧠 From Capital Pressure → Regulatory Friction → Narrative Control

Fast-forward several years, and the battleground shifted from capital allocation to regulatory enforcement.

While this does not prove coordination or intent, it reinforces a consistent pattern we’ve highlighted in Sovereign Signals:

✅ Speculative assets tend to get financialized and absorbed.

✅ Settlement infrastructure tends to face friction, delays, and resistance.

That resistance can show up as:

⚠️ Capital pullbacks

⚠️ Narrative attacks

⚠️ Prolonged regulatory uncertainty

This is not about personalities. It’s about incentives.

Systems that can move value efficiently, cheaply, and globally challenge existing intermediaries more directly than assets designed primarily for speculation.

🔍 What Actually Caused This Flush (The Real Mechanism)

Let’s be clean about causality:

🧨 Narrative shocks can accelerate moves.

🧱 But liquidity + leverage create the environment where “one spark” becomes a liquidation cascade.

This week’s flush looks like a classic “financial plumbing” event:

leverage unwind

forced selling

risk-off flows

macro uncertainty (Fed chair chatter, tariffs, policy noise)

institutions de-risking into safety

When markets break fast, capital doesn’t “debate.” It rotates:

📉 out of risk assets → 🪙 into hard assets → 🏗️ then into infrastructure winners

That is the Golden Age sequence.

🧠 Sovereign Signals Takeaway

You don’t need a conspiracy to explain what’s happening.

You only need incentives, timelines, and repeated behavior.

Crashes expose speculation.

Stress tests reveal infrastructure.

That’s why XRP and XLM keep reappearing at the center of these conversations — and why we continue to frame this cycle as a Golden Age repricing, not just another crypto drawdown.

📈 Is This the Sovereign Signals V-Shape?

Potentially — but selectively.

Here’s the Sovereign Signals framework:

✅ Phase 1: Flush

Leverage unwinds, forced selling, emotional lows

✅ Phase 2: Reprice

Capital reassesses durability and system design

✅ Phase 3: Rotate

Money flows from speculation into rails, settlement, and infrastructure

XRP and similar Golden Age assets historically outperform during Phase 3 — not during the first leg down, but during the rotation that follows stabilization.

📊 Weekly Market Watch — Repricing in Progress

🟠 Bitcoin (BTC) — Macro + Short-Term Reality Check

📌 Insert BTC Monthly Chart

📌 Insert BTC 7D / 30D Chart

Key Support (defense zones):

• $75K–$77K = first battlefield (you’re basically sitting on it)

• $63K–$67K = “if fear returns” zone (big psychological + prior structure zone)

Resistance / Reclaim Levels:

• $81K–$84K = first reclaim zone

• $87K–$90K = “trend confidence returns” zone

Accumulation Approach (if you’re rotating like a grownup):

• Starter adds: $75K–$77K (only if price stabilizes, not free-falling)

• Heavy adds: $63K–$67K (if it flushes there, that’s peak fear opportunity)

Price Direction Projection:

• Next 48 hours: coin-flip volatility + liquidation-driven wicks

• This week: more downside possible if $75K breaks cleanly

• Base case: chop + retest, then either reclaim $81K+ or slide into $60Ks

• Signal to watch: BTC dominance + funding rates (if funding resets + price stabilizes = rotation fuel)

🧠 Interpretation:

BTC is still the liquidity sponge. It can fall and still be “fine.” But if it breaks support, it drags everything — temporarily.

🔵 XRP: Rotation Candidate, Not a First Responder

XRP sold off with the broader market, printing lows in the mid-$1.50s. This is expected — rails are not immune during forced liquidation phases.

Key levels to watch:

🛑 Support: ~$1.50–1.55

🔁 Reclaim zone: ~$1.70–1.85

🚀 Momentum shift: Above ~$1.90 with BTC stabilizing

XRP historically does not lead the first bounce.

It tends to outperform during the rotation phase — when capital shifts from speculation into settlement.

That’s the setup we’re watching.

🟡 Gold (XAU) — Repricing, Not a Top

Key Support (buy-the-dip zones):

$4,400–$4,600 = first support zone (recent structure)

$4,000–$4,200 = deeper macro support (if dollar spikes / risk-off hits)

Resistance / Extension Zones:

$4,850–$5,000 = overhead magnet zone

$5,200–$5,600 = extension zone (if the move turns “monetary event”)

Accumulation Approach:

Accumulate on pullbacks, not on vertical candles

Add when it compresses and holds support (not when it’s euphoric)

Price Direction Projection:

Tomorrow/this week: likely consolidation or modest pullback (after a big run)

Next 2–6 weeks: biased up, unless DXY rips hard

Macro base case: gold remains the “stress barometer” while policy gets messy

🧠 Interpretation:

Gold is acting like a leading indicator for what the public won’t admit yet: currency confidence is fraying.

⚪ Silver — Industrial + Scarce + Monetary (Golden Age Metal)

Let’s be blunt: silver is not “just a metal.”

It’s a strategic input for electrification, grid buildout, solar, advanced manufacturing, and the physical layer of the compute age — while also functioning as a volatility-prone flight-to-safety asset when markets snap.

Silver moves violently because it’s where industrial demand + monetary demand + positioning games collide.

And yes — headlines can matter.

But silver’s real driver is usually bigger:

📌 liquidity + leverage + institutional shorting/covering + physical scarcity dynamics

Key Support (very important):

• $80–$82 = first support zone (current consolidation range)

• $70–$73 = deeper “reset + reload” support

• $60–$67 = if it turns into a full liquidation event

Resistance / Upside Targets:

• $88–$90 = near-term reclaim level (your chart literally marks ~88)

• $100–$118 = breakout extension zone

• $120+ = “policy panic / monetary event” territory

Accumulation Approach:

• Silver is a zone-accumulation asset, not a “one entry and done.”

• Core adds: $80–$82 if it holds

• Aggressive adds: $70–$73 if fear spikes

• Avoid FOMO above $90 unless it’s a confirmed breakout + retest

Price Direction Projection:

• This week: chop + whipsaw likely

• Next few weeks: biased upward as long as $70s holds

• Macro base case: silver behaves like the most chaotic expression of the Golden Age (industrial + monetary)

🧠 Interpretation:

Silver is telling you demand is real — but the market is still trying to shake people out before the next leg.

💵 U.S. Dollar Index (DXY) — The Pressure Valve

Key Support:

• 95.7 = major support zone (clearly marked on your chart)

• 93.7 = next shelf

• 91.7 / 89.7 = if the dollar breaks down hard

Resistance / Reclaim:

• 100.6 = key reclaim zone (your chart marks ~100.6)

• 102–103 = “risk-off returns” zone

Accumulation/Positioning Implication:

• If DXY fails below 100, you stay overweight metals and rails.

• If DXY reclaims 100.6+, expect more chop in risk assets short-term.

Price Direction Projection:

• Near-term: DXY looks weak and heavy

• Base case: grind down or range under 100

• If 95.7 breaks: metals and real assets likely surge again

🧠 Interpretation:

The dollar isn’t “crashing.” It’s losing control quietly — which is exactly how long transitions happen.

📈 S&P 500 — The “Everything Is Fine” Index

Key Support:

6,600–6,700 = first meaningful support zone (recent structure)

6,050 area = major moving average support zone (your chart shows MA region)

Resistance / Extension:

7,000 = psychological ceiling

7,200–7,600 = extension if liquidity ramps again

Accumulation Approach:

Not a “buy everything” moment. This is an environment for selectivity:

Energy/compute/data exposures

Defense-tech, infrastructure, semis, nuclear/uranium, grid buildout

Broad index chasing at highs = weak risk/reward.

Price Direction Projection:

Tomorrow/this week: can drift higher, but fragile

Base case: sideways grind with sudden air pockets

Risk case: if BTC breaks + DXY spikes, equities will get hit briefly (liquidity event)

🧠 Interpretation:

Indexes can stay elevated while the real rotation happens underneath them.

🧱 This Week’s Golden Age Focus

Theme: Repricing → Rotation → Rails

This week isn’t about calling the exact bottom.

It’s about identifying where capital goes after panic.

What we’re watching first:

Rails showing relative strength while BTC stabilizes

Settlement and liquidity narratives replacing hype

Early signs of institutional re-risking into infrastructure

How we’re thinking about entries:

Scale in, don’t swing in

Prioritize proven systems

Treat volatility as inventory, not panic

This week’s goal:

Accumulate durable rails during fear — because when the market turns, it turns fast.

🧭 How We’re Positioning

🚫 No chasing green candles

📉 Scaling entries instead of lump-sum buys

🧠 Favoring systems designed to survive stress, not amplify it

Adding Golden Age equities at support or lower pricing

Crashes are where positions are built —

but only in assets designed to still matter when the noise clears.

⚠️ What Would Change Our View

Bullish confirmation:

BTC holds ~$75K and reclaims $80–83K

Liquidations cool materially

XRP reclaims ~$1.80 with improving relative strength

Bearish continuation:

BTC loses ~$74K with follow-through

Second liquidation wave

No rotation — everything trades as risk

Until then, patience beats prediction.

🏗️ This Week’s Golden Age Focus

🔥 Read this twice.

Crashes don’t reward speed — they reward systems.

This week isn’t about guessing the bottom.

It’s about identifying what doesn’t break under stress.

I’m focused on:

Settlement rails

Infrastructure over speculation

Assets designed to move value, not just attract attention

The Golden Age doesn’t begin with headlines.

It begins with positioning before the crowd understands the shift.

Stay sovereign.

Stay patient.

Stay early.

🔔 Coming Friday — Equities Take the Baton (Equities-Only Focus)

This week was about stress and repricing.

Friday shifts the focus to Golden Age equities — the infrastructure names that get accumulated after volatility, not before it.

We’ll break down:

✅ Which Golden Age stocks we’re watching next (TMC, ABTC, and more)

✅ Where support and accumulation zones actually sit

✅ Why patience — not prediction — wins this phase of the cycle

No chasing.

No noise.

Just disciplined positioning as price comes to us.

📩 Watch for Friday morning’s issue.

In wealth and sovereignty,

Dr. Jen, Your Crypto Clarity Lady 🧠⚡️💸

📜 Legal Disclaimer:

This content is for educational purposes only and does not constitute financial, legal, or investment advice. Cryptocurrency and equity investments involve risk, including total loss. Past performance is not indicative of future results. Always do your research before making investment decisions.

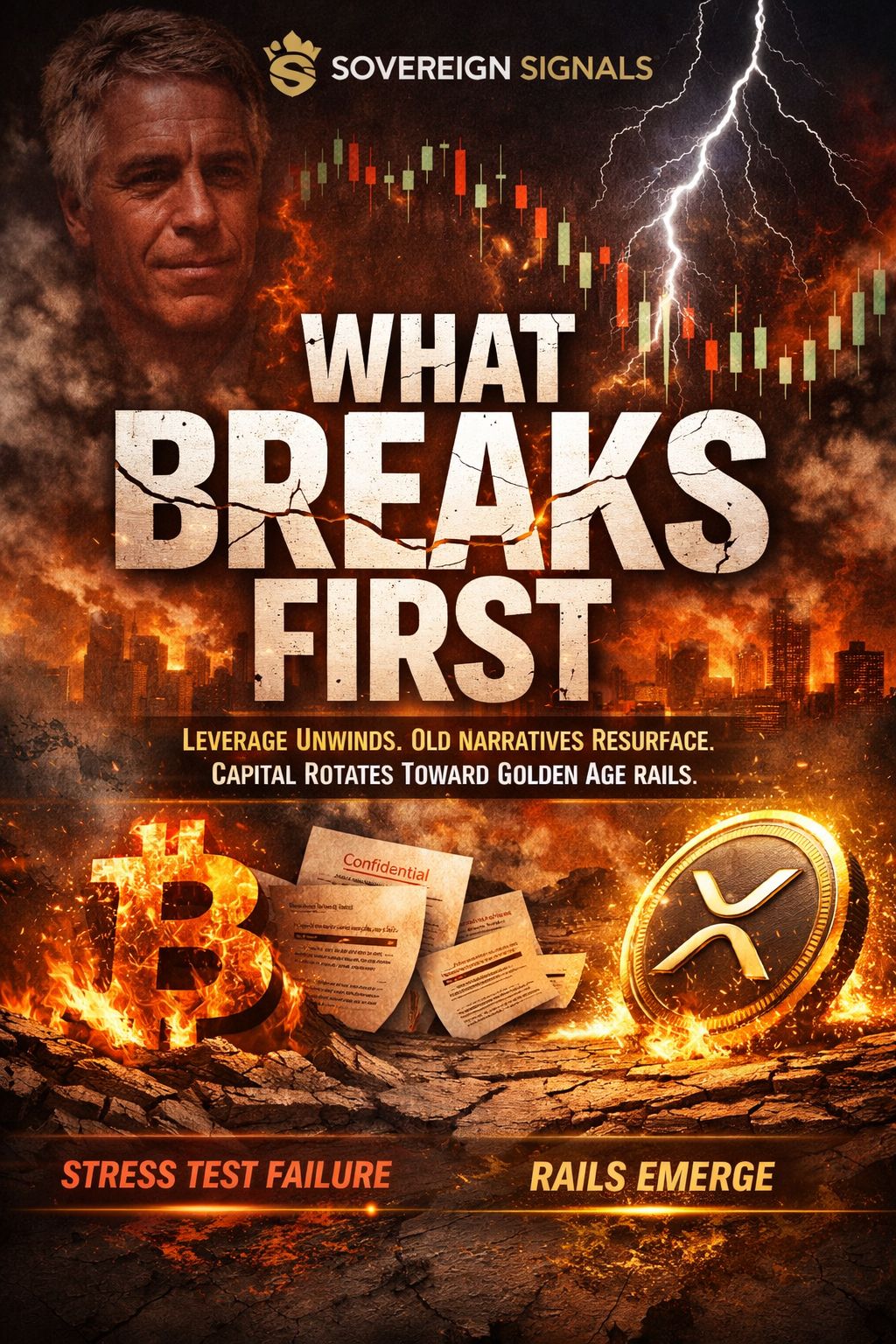

Sovereign Signals Issue Lexicon

Visual Element | What It Signals |

|---|---|

⚡ Lightning fracture | Sudden liquidity shock; forced leverage unwinds rather than organic selling |

📉 Broken market charts | Financialized assets cracking first under stress |

🟠 Bitcoin (BTC) | A macro-sensitive, leveraged risk asset in stress-test mode |

🔵 XRP symbol | Settlement rail designed for throughput, efficiency, and durability |

📄 Stacked documents | Resurfaced history, incentives, and early power dynamics re-entering the narrative |

🌊 Red/black color palette | Fear, liquidation, and emotional capitulation |

🧱 Structural symmetry | Markets breaking along design lines, not randomly |

🔀 Diverging paths | Capital rotation separating speculation from infrastructure |

🧠 “What Breaks First” headline | The central question of repricing: leverage or systems? |

🛠️ Industrial tone | Golden Age framing — infrastructure over hype |