🧠 TL;DR

🚚 FedEx joins Hedera Council → supply chain records move toward a shared ledger

🏛️ Treasury + legislation narrative → capital is policy-gated

🚀 XRPL activates XLS-85 → programmable escrow for issued tokens

📊 MarketWatch → key levels + accumulation zones for Golden Age assets

NOTE TO OUR SUBSCRIBERS: Please ensure you read our newsletters by accessing the online link. Each of our newsletter issues is very detailed, and most email providers cut off content. Therefore, if you only read the email body, you may miss out on valuable information. |

✨ Stay Connected

Follow Sovereign Signals on X for real-time Golden Age alerts: |

Like • Share • Follow — the rails are being built now |

🛡️ SOVEREIGN SIGNALS DYNASTY — COMING SOON |

Sovereign Signals Elite newsletter teaches how to accumulate. |

Designed for: |

Not for thrill-seeking. |

The next layer is coming online. |

🚚 BREAKING: FedEx Joins Hedera Council. Supply chains move toward cryptographic records

FedEx announced it has joined the Hedera Council, the governing body that steers the Hedera network. FedEx will run a network node and participate in governance to support a trusted digital infrastructure for global supply chains.

✅ What this actually means

A node is a computer that helps operate a blockchain/network.

A council member is not “trying it out.” They’re helping run and govern it.

FedEx is positioning Hedera as a potential shared data truth layer for:

📦 shipment records

🧾 verification / audit trails

🌍 cross-border commerce data

⏱️ time-stamped supply chain events

This is “logistics meets ledger.”

This positions Hedera directly inside physical global trade flows.

FedEx is not experimenting with crypto.

FedEx is integrating a shared enterprise data layer for global logistics.

That is the HBAR thesis in action:

Hedera as the trust layer for real-world movement of goods.

When physical supply chains write to Hedera:

data becomes immutable

events become verifiable

records become shared truth

This is the ledgerization of global commerce.

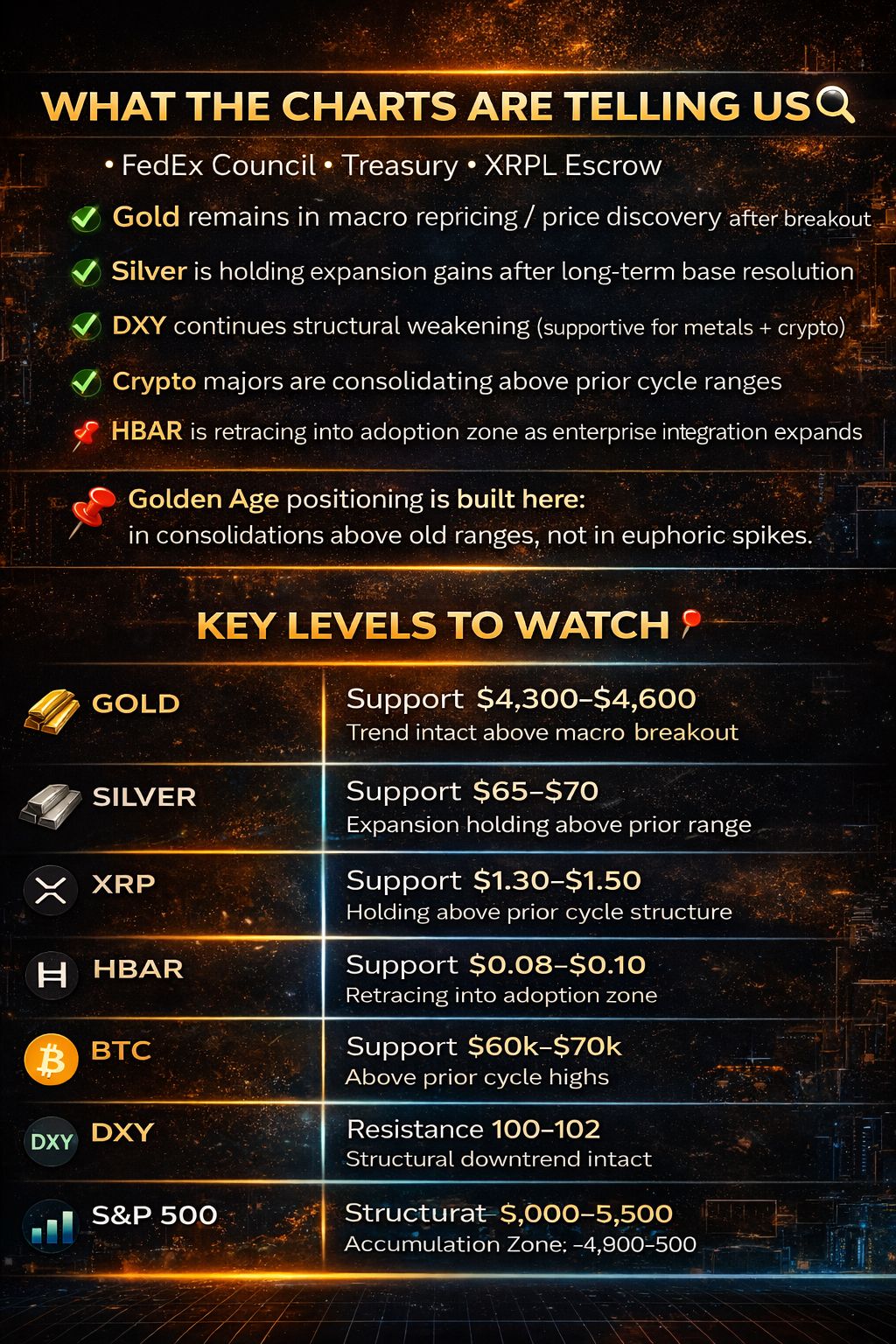

📊 Weekly MarketWatch

Structural Positioning Across Golden-Age Assets

🧭 What you should be doing

This is NOT the moment for:

❌ all-in bets

❌ leverage

❌ emotional buying/selling

This IS the moment for:

✅ accumulation ladders (buy in planned steps)

✅ patience (let structure build)

✅ risk control (know invalidation levels)

Rule: You don’t need the exact bottom. You need coverage across support.

All your accumulation price targets are in Tuesday’s issue.

₿ BITCOIN

Consolidation Above Breakout — Not Collapse

Bitcoin has already done the most important bull-cycle event:

It broke and held above the prior cycle high.

Current price action is a retest of that breakout structure — not a macro breakdown.

🧠 Structure read

✅ Holding above prior cycle ceiling

✅ Testing 200-MA trend support

✅ Momentum reset near cycle lows

✅ Classic post-ATH consolidation

📉 The $48k narrative

$48k sits at:

• deep retrace zone

• prior consolidation base

• long-term channel support

So it’s valid support — but not required.

Bull cycles often bottom above consensus targets.

Bull cycles often bottom above consensus targets.

🧭 Sovereign Signals take

Bitcoin isn’t breaking.

Bitcoin is compressing above its old ceiling.

In macro cycles, ceilings that flip to floors usually hold.

🚀 XRPL UPGRADE

XLS-85 Activated — Native Token Escrow Is Live

XLS-85 is now active on the XRPL Mainnet — meaning issued tokens (not just XRP) can be securely locked and released on-chain via native escrow.

What this opens up:

• programmable vesting

• conditional payments

• institutional token workflows

Beginner translation:

Escrow = “lock it until conditions are met.”

Now XRPL can do that for more than XRP, enabling structured releases and compliance-friendly token logic without external smart contracts.

This expands XRPL from:

payment rail → programmable asset rail

🏛️ POLICY INFLOW SIGNAL

Capital Is Waiting on Permission

We’re seeing an institutional truth stated plainly across the political/media layer:

✅ Regulation clarity is the gate.

✅ When the bill passes, capital allocates.

In other words:

Capital is not waiting on technology.

Capital is waiting on permission.

That matters because the Golden Age sequence is always the same:

rails built → rules clarified → capital deployed

🧭 SOVEREIGN SIGNALS TAKE

FedEx anchoring into Hedera governance is a real-world signal that enterprise data rails are being built.

XRPL adding token escrow expands the programmable settlement layer needed for institutional asset workflows.

Policy momentum signals the “permission layer” is moving.

And markets?

They’re doing what they always do during infrastructure transitions:

consolidate, reset, accumulate — then expand.

In wealth and sovereignty,

Dr. Jen, Your Crypto Clarity Lady

📜 Legal Disclaimer:

This content is for educational purposes only and does not constitute financial, legal, or investment advice. Cryptocurrency and equity investments involve risk, including total loss. Past performance is not indicative of future results. Always do your research before making investment decisions.

📘 Golden Age Lexicon

Term | Meaning |

|---|---|

Golden Age | Multi-decade shift where energy, compute, and data infrastructure are rebuilt and repriced |

Rails | Foundational systems that move value, information, or energy (payments, logistics, compute) |

Data Rail | Networks that secure, verify, and transmit trusted data (HBAR, XRPL) |

Settlement Layer | Infrastructure where assets finalize ownership or payment |

Programmable Assets | Tokens that can be locked, released, or conditioned by code (XRPL escrow) |

Ledgerization | Real-world records (trade, custody, identity) moving onto shared ledgers |

Enterprise Adoption Zone | Price area where institutions integrate infrastructure while markets consolidate |

Policy Gate | Regulation stage that determines when large capital can enter |

Capital Unlock Event | Law or clarity that allows institutional allocation |

Breakout Retest | Price returning to a prior resistance level after surpassing it |

Ceiling → Floor Flip | Former resistance becoming structural support |

Accumulation | Period where long-term buyers build positions during consolidation |

Expansion Phase | Cycle stage where price trends strongly after base formation |

Momentum Reset | Cooling period after rapid price move |

Structural Support | Long-term level where macro trend buyers step in |

Macro Repricing | Asset value adjusting to new economic regime |

Trust Layer | Network providing verifiable shared truth (HBAR thesis) |

Programmable Settlement | Conditional release of value via smart logic (XRPL XLS-85) |

Infrastructure Phase | Market stage where technology adoption grows faster than price |

Golden-Age Positioning | Accumulating during consolidation before institutional expansion |