The Great Repricing is when big money (central banks and institutions) starts re-valuing real assets like gold, silver, and scarce networks higher because trust in “paper promises” is getting thinner. It usually shows up as sharp volatility first — then a new, higher price floor as the system quietly resets its collateral.

Now is the time to own real assets—because when the system reprices collateral, cash gets diluted and the things that can’t be printed reset higher first: metals, infrastructure, and infrastructure crypto (settlement + tokenization rails)—the Golden Age cryptos, stocks, and metals Sovereign Signals tracks.

🛡️ SOVEREIGN SIGNALS DYNASTY — COMING SOON

The family-office command center for the Golden Age.

Sovereign Signals Elite newsletter teaches how to accumulate.

Sovereign Signals Dynasty teaches how to govern the repricing.

Designed for:

⏳ Cycle timing (Benner + Shemitah)

🔁 Rotation strategy (metals → rails → builders → reserves)

🏛️ Legal + jurisdiction positioning

🛡️ Preservation, protection, and legacy execution

Not for thrill-seeking.

For dynasty builders.

The next layer is coming online.

⚡ TL;DR

🛡️ Central banks are rotating reserves from U.S. Treasuries toward gold → the Great Repricing signal.

🥇 Gold is the anchor; 🥈 silver is the volatility amplifier (expect shakeouts, not “over”).

💵 The dollar (DXY) is the near-term pressure valve: higher = more chop, lower = risk-on breathes.

🟠 BTC leads liquidity; 🟦 XRP/rails tend to follow once liquidity stabilizes.

🔁 This is a rotation cycle: metals → liquidity → rails → builders (Golden Age positioning).

NOTE TO OUR SUBSCRIBERS: Please ensure you read our newsletters by accessing the online link. Each of our newsletter issues is very detailed, and most email providers cut off content. Therefore, if you only read the email body, you may miss out on valuable information. |

✨ Stay Connected

Follow Sovereign Signals on X for real-time Golden Age alerts: |

Like • Share • Follow — the rails are being built now |

🧩 CLARITY Is Stalled — What That Means for Crypto (Right Now)

What CLARITY is: the CLARITY Act is the market-structure framework meant to define what a digital asset is (security vs commodity), who regulates it (SEC vs CFTC), and what the rules are for trading, custody, and disclosure in the U.S.

How it helps the GENIUS Act: GENIUS builds the legal highway for stablecoins (tokenized dollars). CLARITY is the rest of the map—the rules governing the broader crypto market, allowing tokenized dollars to move through compliant rails without constant legal ambiguity.

What else is needed to fully turn on the new digital financial system: beyond stablecoin law, the system requires (1) clear market-structure rules (CLARITY), (2) scaled regulated custody and settlement, (3) bank/intermediary compliance standards that work with blockchain rails, and (4) institutional adoption of tokenized assets (treasuries/RWAs) so real volume moves on-chain.

The CLARITY Act didn’t “die.” It stalled.

Senate Banking postponed the markup while negotiations continue, after major industry pushback—most visibly, Coinbase pulling support and calling out problem sections.

🧠 Stablecoin Yield: This Is Banks vs Exchanges

Everyone keeps framing the stablecoin yield fight as “regulators vs crypto.”

Nah.

This is banks vs exchanges — a turf war over who gets to hold, deploy, and profit from the world’s new cash pile.

🏦 Why banks are pushing back

Banks don’t hate stablecoins because they’re “scary tech.”

They hate them because stablecoins can behave like cash deposits without bank charters.

If customers can park dollars in stablecoins and earn yield, that’s:

deposits leaving the banking system

funding costs rising for banks

less control over money flows

Banks want stablecoins to either:

sit inside bank rails, or

lose the “deposit-like” yield feature.

🧊 What’s getting squeezed: “idle yield”

The direction of market-structure policy is to kill idle yield:

Idle yield: “Hold stablecoins and earn just for sitting still.”

That’s the feature that makes stablecoins look most like a bank account.

🏦🆚🏪 Why exchanges are fighting this

Exchanges want you to park capital on-platform. It’s the same core game:

you park funds

they deploy it (or profit from the float)

they keep most of the spread

you get a reward drip

If idle yield gets restricted, exchanges lose:

sticky balances

float

control

revenue leverage

So of course they’re pushing back.

✅ What survives: yield tied to real activity

Yield tied to:

lending/borrowing

liquidity provision

network participation

real usage

…has a stronger chance of surviving because it’s framed as market activity, not “deposit interest.”

Translation: circulation > parking.

🧬 Sovereign Signals Takeaway

This is banks trying to defend the deposit franchise.

This is exchanges trying to defend on-platform float.

Banks vs exchanges.

And regulation is the battlefield where the winner gets to run the new cash system.

🛡️ Know what you hold.

👀 What to watch next (the plumbing signals)

📅 New markup date/schedule updates

🧾 Changes to the most controversial sections (stablecoin yield language, DeFi scope, tokenized equity language)

🏛️ Whether industry support returns (because “bad legislation is worse than none”)

🛡️ Sovereign Signals Takeaway

Stalled CLARITY = more chop now, slower institutional onboarding, and a delayed “clarity premium.” But if this pause produces a cleaner bill, it’s ultimately bullish—because the market needs rails, not fog.

🟡 Central Banks Are Swapping “Paper” for “Metal”

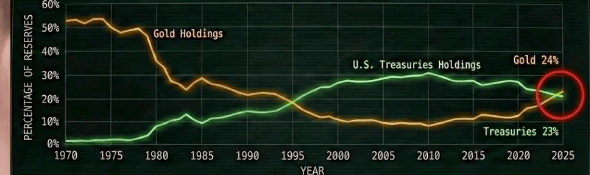

🟡 Central banks are shifting reserves back to gold. For the first time in ~30 years, gold’s share of foreign reserves is matching/exceeding U.S. Treasuries — a quiet signal that sovereigns are diversifying away from “paper” toward neutral hard collateral.

This chart essentially serves as a trust scoreboard.

Orange line (Gold holdings) = how much foreign central banks choose to hold in gold as a % of reserves.

Green line (U.S. Treasuries holdings) = how much they choose to hold in U.S. government debt as a % of reserves.

🧠 What it’s telling us (in plain English)

✅ For decades, foreign central banks leaned harder on U.S. Treasuries (the “safe yield” bucket).

✅ Recently, that trend has flipped back toward gold — meaning: less confidence in long-duration paper, more preference for neutral reserves that don’t rely on U.S. policy choices.

🔥 Why this matters for markets

🟡 Gold: structural bid stays strong (central bank demand = slow, relentless buying).

🥈 Silver: tends to get wilder when gold leads (higher beta metal; more volatility).

💵 DXY: can still rally in short bursts (risk-off), but reserve behavior is a longer-term headwind for “paper dominance.”

📈 Rates / Treasuries: if demand for U.S. debt weakens at the margin, it can mean more volatility in yields (not instantly, but structurally).

🟠 BTC: benefits in the same philosophical lane as gold (neutral reserve asset narrative), especially during credibility cycles.

📊 Weekly Market Watch — Updated With Today’s Charts

⚡ TL;DR

🥈 Silver just printed a violent repricing candle (high volatility, big trend) • 🟠 BTC is in a reclaim phase (trying to rebuild the bull staircase) • Expect shakeouts + retests before the next clean expansion leg.

🥈 Silver (~$90) — Repricing Candle Mode

Today’s silver structure is “breakout + overshoot + inevitable retest.” That’s not bearish — that’s how monetary metals behave when they start acting like a stress signal.

📍 Band: $84 – $94

✅ Accumulation: $86 – $90 (primary retest zone)

🛡️ Major Support: $73 – $75 (the “if this breaks, the move resets” level)

🎯 Targets: $93 – $95 (retest of the high)

🚀 Breakout: >$94 holds → $100+ (next expansion shelf)

⚠️ If weak: <$86 → $80–$82 (deep reset); then $73–$75 (major floor)

Beginner translation: silver can drop hard and still be bullish — the key is whether it holds the retest zones after the vertical candle.

🟠 Bitcoin (BTC) (~$95.5K) — Reclaim + Base-Build

BTC is trying to rebuild the “bull staircase” after a major drawdown. On the higher timeframes, the big line in the sand is the 200-week area (deep cycle support), while the nearer-term battle is reclaiming the mid-90s and pushing back through 100K.

📍 Band: $90K – $100K

✅ Accumulation: $90K – $94K (reload zone on dips)

🛡️ Major Support: $78K – $82K (cycle floor / deep support zone)

🎯 Targets: $98K – $100K (decision zone)

🚀 Breakout: >$100K holds → $105K – $110K (momentum unlock)

⚠️ If weak: <$90K → $88K; then $82K–$78K (major floor)

Beginner translation: BTC is bullish as long as it holds the staircase base (low-90s first, then high-70s as the deep floor). The next real acceleration needs $100K to hold.

🧬 What This Means (Metals + DXY + Markets)

Silver moving like this usually means stress + repricing + leverage being forced out. That can temporarily spill over into broader markets because when margin and collateral rules tighten, everything gets noisier.

Here’s the clean map:

🥈 Silver leads the stress signal (truth serum asset).

🟠 BTC follows liquidity (it accelerates when the market stops de-risking).

💵 If the dollar stays firm, it can cap risk-on in short bursts (more chop, more fakeouts).

The “Golden Age ignition” feel returns when volatility resolves into higher lows and BTC can hold breakouts instead of rejecting them.

🧭 Beginner Action List (Do This, Not Chaos)

🥈 Silver: focus on retests (86–90). Don’t chase vertical candles.

🟠 BTC: treat 90–94K as reload; >100K holds = breakout mode.

🧠 Expect volatility: repricing phases shake out leverage before they reward conviction.

In wealth and sovereignty,

Dr. Jen, Your Crypto Clarity Lady

📜 Legal Disclaimer:

This content is for educational purposes only and does not constitute financial, legal, or investment advice. Cryptocurrency and equity investments involve risk, including total loss. Past performance is not indicative of future results. Always do your research before making investment decisions.

Golden Age Lexicon

Term | Meaning (Beginner-Friendly) |

|---|---|

🛡️ Great Repricing | A shift where big money resets the value of “real” collateral higher (gold, silver, scarce networks, infrastructure) as trust in paper weakens. |

🏦 Central Bank Reserves | The stash of assets countries hold for stability (often USD, Treasuries, and gold). |

🟡 Gold Share vs Treasuries Share | A “trust meter” showing whether reserve managers prefer metal (gold) or U.S. government debt (Treasuries). |

🧾 U.S. Treasuries | U.S. government bonds—“paper collateral” that pays yield but depends on fiscal policy and rates. |

🪙 Hard Collateral | Assets with no counterparty promise (gold/silver) used as sovereign insurance. |

🥇 Gold (Anchor Metal) | The steady monetary hedge—moves slower, holds value when credibility gets tested. |

🥈 Silver (Accelerator Metal) | The higher-volatility cousin of gold—often spikes harder and whips more in repricing phases. |

💵 DXY | U.S. Dollar Index—when it rises, it can pressure metals/crypto; when it falls, risk assets breathe. |

📉 Real Rates | Interest rates after inflation; falling real rates often help gold/silver and risk assets. |

🧨 Leverage Squeeze | When margin requirements and volatility force traders to sell, creating sharp drops even in bull trends. |

🧱 Support | A price zone where buyers usually defend and price often bounces. |

✅ Accumulation Zone | A preferred area to build a position in tranches (adds on dips) instead of chasing spikes. |

🎯 Targets | Likely “magnet” levels where price may stall, take pro |